All about Transaction Advisory Services

Wiki Article

Little Known Questions About Transaction Advisory Services.

Table of ContentsTop Guidelines Of Transaction Advisory ServicesExcitement About Transaction Advisory ServicesSome Known Factual Statements About Transaction Advisory Services The Best Strategy To Use For Transaction Advisory ServicesThe Greatest Guide To Transaction Advisory Services

This action ensures the company looks its finest to potential purchasers. Getting the business's worth right is critical for a successful sale. Advisors make use of different methods, like affordable cash circulation (DCF) analysis, contrasting with similar business, and current deals, to find out the reasonable market price. This helps set a reasonable price and negotiate effectively with future customers.Deal experts action in to aid by obtaining all the required details organized, responding to concerns from customers, and arranging visits to the company's location. Deal experts use their experience to help service owners manage hard negotiations, satisfy purchaser assumptions, and framework bargains that match the proprietor's goals.

Fulfilling legal policies is vital in any organization sale. They assist company proprietors in intending for their next steps, whether it's retirement, starting a brand-new endeavor, or managing their newly found wide range.

Transaction experts bring a wide range of experience and knowledge, making sure that every facet of the sale is taken care of professionally. With calculated prep work, evaluation, and settlement, TAS assists entrepreneur achieve the greatest feasible sale cost. By making sure legal and regulatory compliance and managing due diligence along with other offer employee, purchase experts decrease prospective threats and obligations.

Fascination About Transaction Advisory Services

By contrast, Big 4 TS teams: Deal with (e.g., when a possible purchaser is conducting due diligence, or when an offer is closing and the buyer requires to integrate the firm and re-value the seller's Balance Sheet). Are with fees that are not linked to the offer shutting efficiently. Gain fees per engagement someplace in the, which is less than what financial investment banks gain also on "tiny offers" (however the collection probability is also much higher).

, but they'll concentrate more on accounting and evaluation and much less on topics like LBO modeling., and "accountant only" subjects like test equilibriums and how to stroll via events using debits and credit scores instead than monetary statement changes.

Getting My Transaction Advisory Services To Work

Specialists in the TS/ FDD teams might additionally talk to monitoring concerning whatever above, and they'll compose a comprehensive report with their searchings for at the end of the procedure., and the basic shape looks like this: The entry-level role, where you do a lot of information and monetary analysis (2 years for a promo from here). The following level up; comparable work, yet you get the more interesting bits (3 years for a promo).

Specifically, it's hard to obtain promoted past the Manager level because few individuals leave the work at that stage, and you need to begin showing proof of your capacity to produce income to development. Let's start with the hours and lifestyle considering that those are site simpler to describe:. There are occasional late evenings and weekend break job, however nothing like the frenzied nature of financial investment banking.

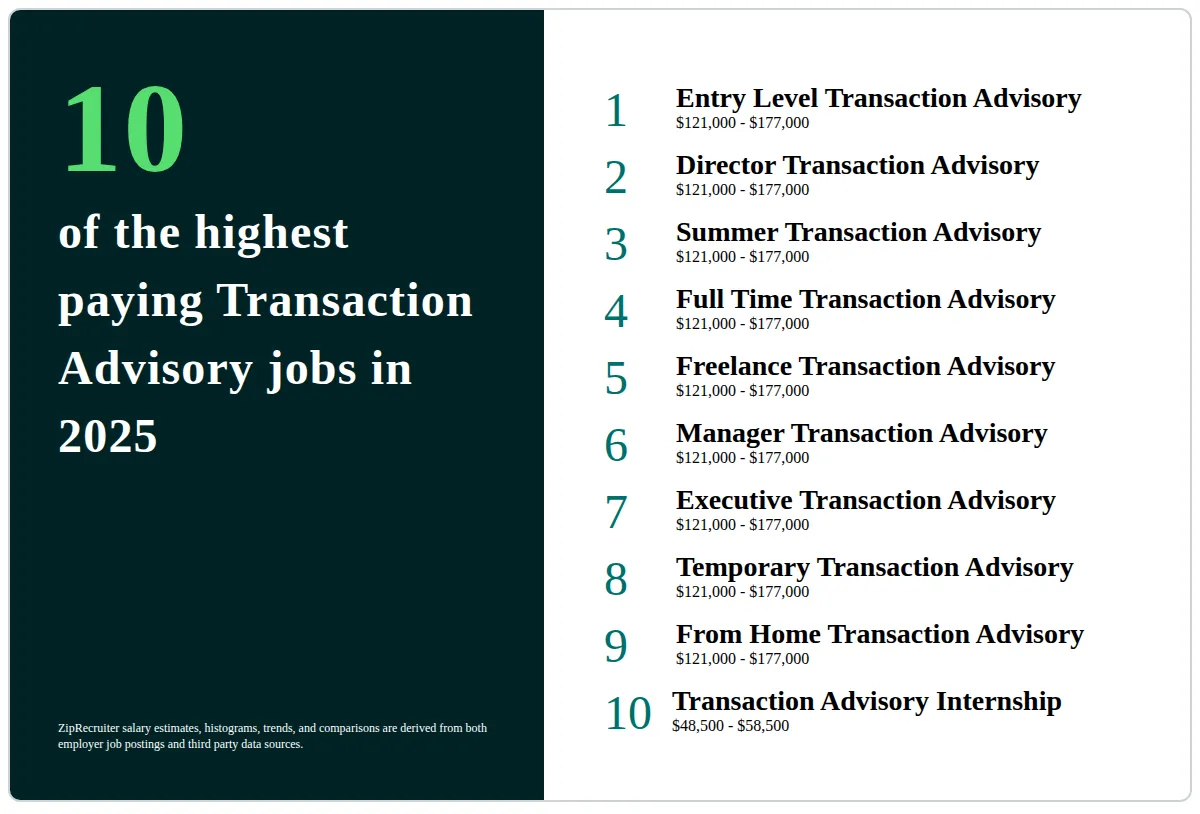

There are cost-of-living modifications, so expect lower payment if you're in a cheaper location outside significant monetary (Transaction Advisory Services). For all settings other than Companion, the base pay consists of the mass of the total compensation; the year-end bonus may be a max of 30% of your base wage. Usually, the best way to boost your profits is to change to a different firm and negotiate for a greater wage and reward

What Does Transaction Advisory Services Do?

You might enter into company advancement, but investment banking obtains harder at this stage due to the fact that you'll be over-qualified for Analyst duties. Corporate financing is still an option. At this stage, you ought to simply stay and make a run for a Partner-level duty. If you desire pop over to these guys to leave, maybe transfer to a client and do their assessments and due persistance in-house.The major problem is that since: You typically require to join an additional Huge 4 team, such as audit, and job there for a couple of years and then relocate right into TS, work there for a few years and after that relocate into IB. And there's still no assurance of winning this IB role since it depends upon your region, clients, and the hiring market at the time.

Longer-term, there is additionally some risk of and because reviewing a firm's historical monetary info is not specifically brain surgery. Yes, humans will certainly constantly need to be included, yet with even more advanced technology, reduced headcounts can potentially sustain customer interactions. That stated, the Purchase Providers team defeats audit in regards to pay, work, and departure possibilities.

If you liked this article, you may be curious about analysis.

What Does Transaction Advisory Services Do?

Create innovative monetary structures that help in establishing the real market price of a firm. Give her latest blog advisory work in relationship to service valuation to aid in bargaining and prices frameworks. Discuss one of the most appropriate form of the bargain and the sort of factor to consider to employ (money, supply, gain out, and others).

Perform integration planning to establish the process, system, and business adjustments that might be needed after the deal. Establish standards for integrating departments, innovations, and business procedures.

Evaluate the prospective customer base, industry verticals, and sales cycle. The functional due diligence provides essential understandings into the performance of the firm to be obtained concerning risk analysis and worth development.

Report this wiki page